One of the keys to success in the Forex business, is having the ability to identify high probability reversal patterns on the chart.

There are many reversal patterns that present themselves on the chart every day, but not all of them are high probability. I am going to talk about some of the better patterns and how you can use them in your trading.

The Engulfing Candle.

![]() An engulfing candle or outside bar as its sometimes called, represents a complete change in trader sentiment. The way an engulfing candle forms is probably one of the biggest clues that a reversal or a potential reversal is on the cards.

An engulfing candle or outside bar as its sometimes called, represents a complete change in trader sentiment. The way an engulfing candle forms is probably one of the biggest clues that a reversal or a potential reversal is on the cards.

Engulfing candles often form at the end of a trend and can be great reversal signals. The logic behind the engulfing candle is very powerful indeed, and the candle will change bulls into bears and bears into bulls in a very short space of time.

An engulfing candle is a very basic price action set up, but works very well at key reversal levels in the market. For more information on how to trade engulfing candles click here.

The Inside Bar.

An inside bar is basically a candle that forms inside another candle. Inside bars represent indecision in the market, and can be good indications of a potential reversal. They are not as powerful as engulfing candles, but when traded at good levels, they can produce a successful trade.

An inside bar is basically a candle that forms inside another candle. Inside bars represent indecision in the market, and can be good indications of a potential reversal. They are not as powerful as engulfing candles, but when traded at good levels, they can produce a successful trade.

Inside bars can also produce a nice breakout trade. Breakouts work best when you have a multiple inside bar set up. A multiple inside bar set up can sometimes be called a flag, or a pennant. Multiple inside bar set ups will produce a much stronger breakout trade than a one bar set up, purely because the volume of orders in the market will be much larger, and as the price breaks out, and the stops are hit the move will be more powerful.

For more information on how to trade inside bars click here.

The Head And Shoulders Pattern.

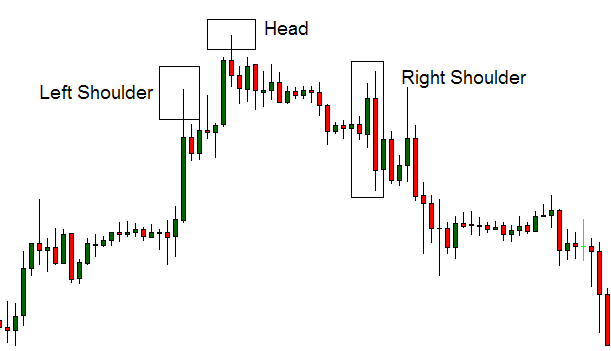

The head and shouldlers, or inverse head and shoulders pattern, is also a very good reversal pattern and you will often find them at the end of trends, and at major turning points in the market. The head and shoulders pattern can be a very profitable pattern if you know how to trade it correctly.

Below is a picture of a head and shoulders pattern. You can also see that the right shoulder is made up of an engulfing candle, which makes the set up even stronger.

This set up works well when the left shoulder and the right shoulder are at the same level, but this does not always have to be the case for a head and shoulders reversal to work, but the head always has to be above the left and the right shoulder.

These are just some basic price action reversal patterns that you can use to help you in your trading. If you want to learn more advanced high probability reversal patterns please consider my Forex training course.