Trading the news can be very profitable if you can predict which way price is going to move. Entering a trade just before a news release can net you 30 or 40 pips very quickly if you get the direction right. But predicting which way price is going to move is very much a gamble, so most traders do not trade the news, as its just too risky, and you often get stopped out, as price quickly moves one way, and then the other. This type of move is known as a whipsaw. Most traders have experienced this whipsaw effect, when price goes up then down very quickly, and it seems no matter which way you trade, you always seem to get stopped out.

Now i look at the charts in a very different way to 95% of traders out there, and i can always see an opportunity in whatever the market throws at me. When you understand why the market moves as it does, you can profit from almost any trading scenario, and trading the news can also be a great opportunity to profit from the market.

A strategy for trading the news is probably one of the hardest things to develop, but if you understand what is happening to price then its a lot easier. Now i am not going to go into the ins and outs of price action, and how i use it, but i would like to give you a simple but effective strategy for trading the news. This strategy can give you over 100 pips profit on a major news release if used on multiple pairs.

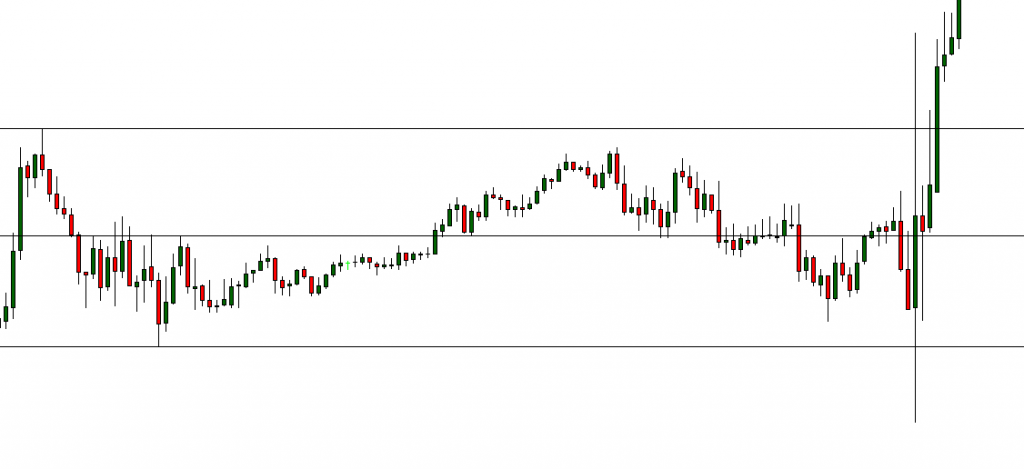

Now the big problem with developing a strategy for trading the news is stop losses. When most traders enter trades they set a stop loss. That stop loss could be anything from 10 pips to 30 pips, or more if you are trading higher time frames. Now if you are trading the news on the 15 min time frame, and you set a stop loss how big should it be? 10 pips, 20 pips, 30 pips, more? It is very difficult to set a stop loss for a news announcement, as you don’t know how big the move is going to be? So if you don’t know how big the move is going to be, how can you set a stop loss? You can set a stop loss above a recent high, or below a recent low, but a big whipsaw like the one in the screenshot below will still wipe you out. So what do you do? How do you profit from a move like that? Well the trading strategy below will describe what you need to do to make money from a news based whipsaw move.

If you think about what happens in a whipsaw, price goes up, stops out short traders, price goes down, stops out long traders. Now you know price is going up, to stop out shorts, and you know its going down to stop out longs, so this is what you do. You enter two trades, one long, one short, as close as you can to the the mid price of the move that leads up to the whipsaw. If you look a the screenshot above, this would be the middle black line. You set a take profit on both trades of 15 to 20 pips. You can go for more pips if the news is big, and you are going to get a bigger whipsaw, an interest rate decision for example, but 15 to 20 pips is a safe amount to go for.

If you think about what happens in a whipsaw, price goes up, stops out short traders, price goes down, stops out long traders. Now you know price is going up, to stop out shorts, and you know its going down to stop out longs, so this is what you do. You enter two trades, one long, one short, as close as you can to the the mid price of the move that leads up to the whipsaw. If you look a the screenshot above, this would be the middle black line. You set a take profit on both trades of 15 to 20 pips. You can go for more pips if the news is big, and you are going to get a bigger whipsaw, an interest rate decision for example, but 15 to 20 pips is a safe amount to go for.

Now the important part of this strategy is NOT to set a stop loss. Your take profit becomes the stop loss. Most traders will be trading this with a 20 to 30 pip stop loss, you trade it with a take profit instead of a stop loss. Price goes up, hits your take profit, price goes down hits your take profit. As price is hitting other traders stop losses, its hitting your take profit. But because you are trading without a stop loss, it does not matter which way price goes first, you are not going to get stopped out, you are only going to get your take profit hit. Does that make sense? Read it again if you are unsure.

Now there are a couple of important things you need to be aware of before you use this type of strategy for trading the news. The news release must be a high impact release, ( you can check which news releases are high impact on the calendar on the homepage ) NFP, interest rate decision, FOMC etc. A high impact news release is much more likely to produce a whipsaw move. The market also has to be moving in a tight range before the news is released. Check the screenshot above for an example of what you are looking for. This is VERY important. When the market has been moving in a tight range before the news traders stop losses are in easy reach of the whipsaw. If price has been going up, or going down before the release, then the whipsaw is less likely to happen. If you have the tight range that you need, you must enter as close to mid price as you can, so you are not exposed at the end of the range. If you are, your 15 or 20 pip take profit may not get hit in both directions.

Something else you can do to maximize your profit, is to trade this strategy on more than one pair. If the news is euro related, trade all euro pairs, if its dollar related, trade all dollar pairs, if its Yen related, you get the idea. As long as you have the tight range you are looking for before the news release you can trade any relevant pair. Trading more than one pair will also spread your risk, just in case you do not get the whipsaw on all the pairs. As long as you get it on the majority of pairs you will still make plenty of pips, and your take profit will get hit one way or another.

Please note: I am not a news trader. The strategies i employ for trading are low risk high probability trading strategies. A lot of my trading is based on chart logic, and this strategy is a logical way to trade the whipsaw on this type of news release. If you are a news trader then this strategy will hopefully help you understand the whipsaw, and how to profit from it. If you decide to use this strategy or not, i hope its been enjoyable reading, and made you think about the market a little differently. Making money from trading is all about understanding what is happening on the chart, and thinking outside of the box. 🙂

If you enjoyed this article and you think it would benefit other traders, please like it on Facebook share it on Twitter, or bookmark it using the buttons below. Thanks for visiting my blog and have a great trading day.

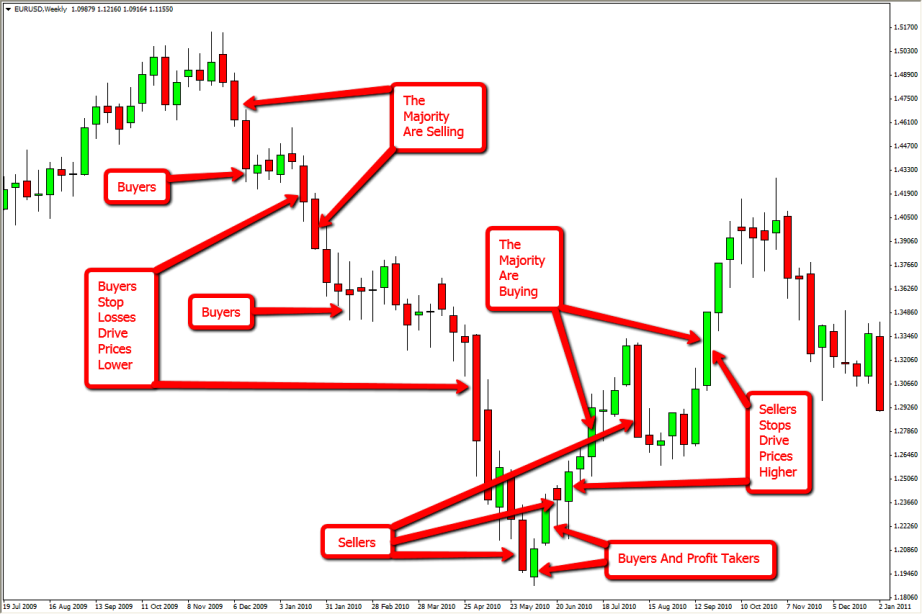

I was prompted to write this article after a conversation I had with a trader yesterday. He came to me as he was considering taking my training course, but he told me he was already receiving training and mentoring from another “professional trader” but he was struggling to make money in the markets and could not work out whether price was going up or down.

I was prompted to write this article after a conversation I had with a trader yesterday. He came to me as he was considering taking my training course, but he told me he was already receiving training and mentoring from another “professional trader” but he was struggling to make money in the markets and could not work out whether price was going up or down.