Choosing the right Forex broker can be a pretty daunting experience. I have been trading for over 12 years in both stocks and Forex, and I have used many brokers in that period. Some good, some not so good. So how do you choose the right one?

There are 100s of Forex brokers to choose from, and they all want your business. Some brokers will offer you incentives to join them, like introductory bonuses or free commission periods. Some of these deals sound very attractive, but when you read the small print, the offers tend to be very restrictive, and weighted heavily in favor of the broker, so they are generally not really worth signing up for.

Tips for choosing the right Forex broker.

There are some rules that you need to follow when choosing a Forex broker. I am going to list them below, not particularly in order of preference, but you do need to consider them all before choosing the right broker.

There are some rules that you need to follow when choosing a Forex broker. I am going to list them below, not particularly in order of preference, but you do need to consider them all before choosing the right broker.

Regulation.

You must trade with a regulated Forex broker in my opinion. You don’t want to be giving your money to any old Forex broker, just because he is offering you what seems like a great deal. Regulated brokers are far more trustworthy, and your money is held in client segregated accounts, with reputable banks, and not with the broker. So if your broker got into financial difficulties for any reason, you know your money is protected from any creditors that may come after the broker. I have heard some horror stories of clients losing a lot of money by dealing with unregulated brokers.

Commission Charges.

Commission charges are a major thing to consider when choosing a Forex broker. One of my students has just swapped from Fx Pro to IC Markets, and we have worked out at his current level of trading activity, he will be saving around £86.000 per year in commission charges by swapping to IC Markets.

Spreads.

Spreads are the difference between the buying and selling price of an instrument and are also a big game changer when it comes to choosing the right Forex broker. Some brokers spreads are good on Euro-Dollar but very poor on all others. For example, IG index has a spread of less than a pip on Euro Dollar, but Cable can be up to 3 pips. In their defense they are a spread betting company, that do not charge commission, but even so, 3 pips is a big spread if you are scalping the Forex market.

You need to find a broker with great spreads on all pairs that you intend to trade. Spreads on the major pairs with most brokers are pretty competitive, but i don’t just trade the majors, so i need a broker with great spreads on all the pairs I trade.

Slippage.

Slippage is the difference between the expected price of a trade, and the price the trade actually executes at. You get slippage with all brokers, sometimes it goes in your favor, but most of the time it goes against you.

Slippage is the difference between the expected price of a trade, and the price the trade actually executes at. You get slippage with all brokers, sometimes it goes in your favor, but most of the time it goes against you.

Because the market moves so quickly, the price you are quoted for execution can change in the time it takes you to close or open the trade. Some brokers take advantage of slippage by nicking pips off you, and putting it down to slippage, this is not acceptable, and any brokers that do this are not reputable and should be avoided.

During major news announcements slippage can be more evident with your broker, and you may not get such a good fill during these times, but in normal trading conditions slippage should happen occasionally, and if you do get slipped, it should be no more than a pip with a reputable Forex broker.

Hedging.

Hedging is the ability to open an opposing position in the same pair, without having to close your original position. For example: If you are short Euro Dollar, and price is going up, you may not want to close your short trade, as you feel this could just be a temporary move up. You want to take advantage of this temporary move by going long, so you open a long position, which effectively hedges your short position. By hedging, you are making money on the temporary move up, without having to take a loss on your short trade. You can close your long trade when you feel price is going to reverse, and when price comes back down again, your short trade comes back into profit.

Please note: Hedging can be a very dangerous game to play if you do not fully understand what you are doing, but it can also be a useful flexible tool if used correctly.

Most brokers these days offer a hedging facility, but some don’t, so make sure the broker you choose does offer this facility.

True ECN.

ECN stands for electronic communications network. ECN is the technology that allows price makers to send executable streaming prices (bids and offers) to the market, constructing a virtual order book in much the same fashion as a stock exchange would. By trading with a true ECN broker your orders are filled quickly and at the best possible price. ECN trading offers clients a deep liquidity pool and tighter spreads than non ECN brokers. Trading with a non ECN broker will lead to more re quotes, and wider spreads.

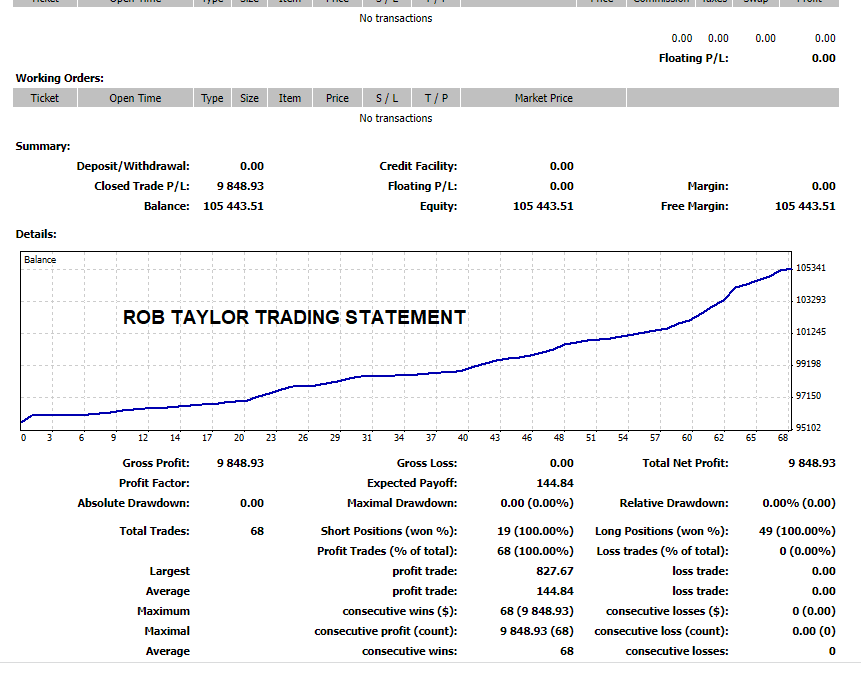

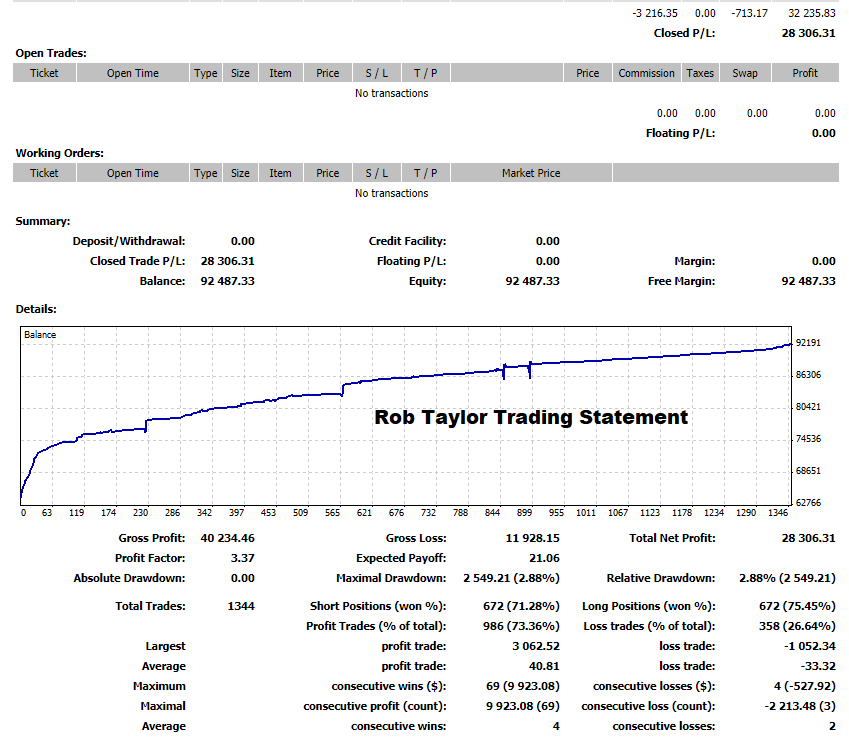

My Recommended Broker.

I hope that these tips have made the job of choosing the right Forex broker a little easier for you. My recommended Forex broker is IC Markets. They are a fully regulated true ECN broker, with incredibly tight spreads, and great commissions. They also offer hedging facilities to their clients, and scalping is allowed if you trade that way. You can also run expert advisors with IC Markets too if you need that facility.

If you enjoyed this article and you think it would benefit other traders, please like it on Facebook share it on Twitter, or bookmark it using the buttons below. Thanks for visiting my blog and have a great trading day.