Does that sound like a silly question? Its not. Its a perfectly reasonable question, but think about it a while before you answer it.

People get involved in this business for many reasons, but the main reason people get into this business is to make more money, and to have more free time. But the strange thing is, for the majority of people that trade the Forex market the reverse happens, they have less free time and less money.

Even for the majority of profitable traders, time spent in front of the screen in proportion to the money they make is not even minimum wage. Out of the 5% of traders that consistently make money from Forex trading, only about 10% of them actually make it to the point where they are making life changing amounts of money.

Why is this? The answer is simple, the driving force behind most peoples foray into the Forex business is money. They want to make money, and lots of it. So what is wrong with that you ask. Nothing at all. 20% of the worlds wealthiest people have made their money in the finance industry.

Why is this? The answer is simple, the driving force behind most peoples foray into the Forex business is money. They want to make money, and lots of it. So what is wrong with that you ask. Nothing at all. 20% of the worlds wealthiest people have made their money in the finance industry.

So whats the problem? Well the problem is you have to be good at your job if you want to make money, and the better you are at it, the more money you will make. You cant say i want to make more money next week than i made this week. That will only happen if you are a better trader next week than you are this week.

So now answer the question, do you want to make money, or do you want to be a great Forex trader. If you want to make money, forget about trading and contact me about my managed account service.

If you want to be a great trader then contact me about my Forex training course.

Is it possible to make life changing amounts of money from Forex trading?

Yes it is. But to make life changing money from the Forex business you have to be a great trader. Most people fail in this business because they want to make money, they don’t want to be great traders.

Any job that requires you to have a skill requires a period of training, an apprenticeship to be a tradesman lasts for 4 years, doctors, vets, solicitors study for much longer than that. So why do people think they can enter this business with no skill, and make lots of money very quickly.

Because its easy right? Forex trading is really easy, and anyone can do it, you just need to pay a few 100 dollars for a training course, set up an account with a broker, and you are on your way to your first million. In reality that will not happen, and for the majority of new traders making a million from trading is just a pipe dream.

Here’s a question for you. How do you walk away from this business after 12 months with a million pound in your account? You start with 10 million. 🙂

To be a great Forex trader you have to have, education, determination, discipline, and a skin as thick as a rhino. I have been in the trading business for many years, and there is nothing else i enjoy more than taking money out of the market, but the reason i can do that is because i am a great trader. I always wanted to be a trader, and i will always be a trader. Making money from the markets is a by product of being a great trader.

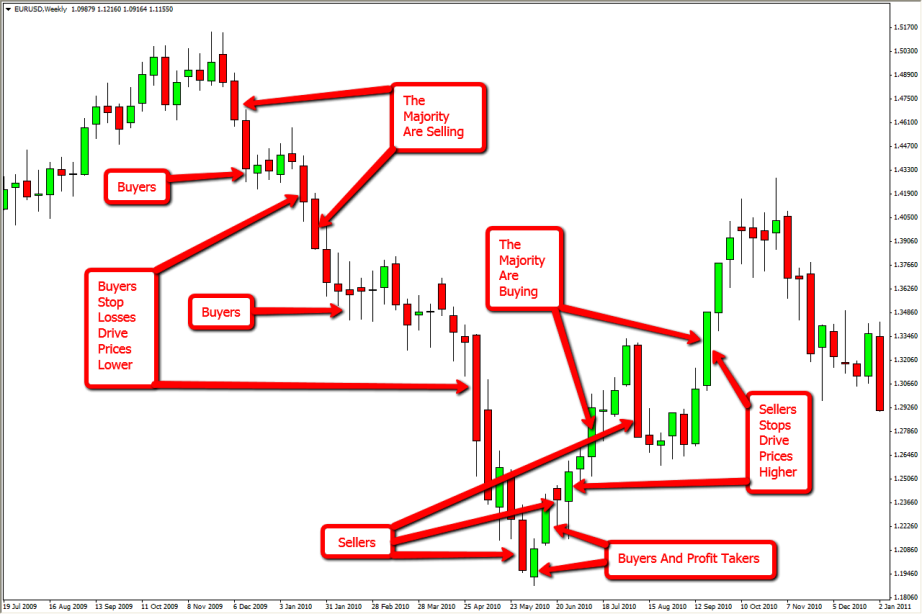

Most traders make money by pure luck rather than judgement. Think about this for a minute and this is 100% true. If you closed your eyes and randomly hit the buy or sell button, you would have more successful trades than the average retail Forex trader. I am not going to go into detail of why that is true, but it is.

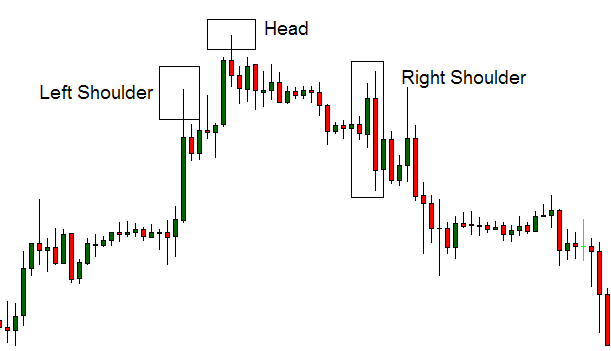

A complete understanding of the market and the forces that drive price is the only thing that will make you a great trader, and consistent profitability will be within your reach. So if you do not have that understanding, and you feel that there is something missing from your trading methodology, then please feel free to contact me for an informal chat, about how i can help you become a great trader and take your trading to the next level.

Now answer the question again, do you really want to be a profitable Forex trader?

Thanks for visiting my blog, have a great day. 🙂