I am not going to name names here, but i was watching a video from a well respected Forex training provider today, and it prompted me to write this article.

I am not going to name names here, but i was watching a video from a well respected Forex training provider today, and it prompted me to write this article.

His training course is heavily weighted towards the premise that you will have more success if you use fundamental analysis rather than technical analysis.

The provider stated that professional traders, hedge funds, investment banks etc, are 80% fundamental and 20% technical. All of their trading decisions are based on macroeconomics and they are just using a 20% technical approach to help with market entries.

Now this is all perfectly reasonable, and i teach fundamental as well as technical analysis in my training course, but is fundamental analysis better than technical analysis? I don’t think it is.

Fundamental analysis will only give you an opinion of the market direction, and opinion is subjective. Sometimes your opinion is correct, and sometimes its incorrect. Just because you think something is going to happen, does not mean it will happen.

There has been a strong fundamental case for a number of months now, for the BOJ to expand on monetary easing, but they have not done it as yet. So if you have been buying yen pairs based on that, then you are in a bit of bother right now.

Putting fundamental analysis to the ultimate test.

Now is a great time to put fundamental analysis to the ultimate test. Lets take the Brexit vote for example. Now if Fundamental analysis was the best thing since sliced bread, and you were a hedge fund trader, or an investment bank, you would have been on the right side of the Brexit move.

Now do a search on Google to find out how many of these guys were on the right side of that move. There are 1000’s of hedge funds and investment banks, but it seems only 1 guy made any serious money on the move. And that was Crispin Odey. Crispin is a well respected hedge fund guy and he made 220 million on Brexit. See Brexit buccaneer rakes in £220million.

I would just like to point out that Crispin manages an 8 billion fund. So although he made 220 million, he only made a 2.75% return on that particular trade. Yes i agree its not too shabby, but people need the facts i think.

If the title of the article was “Brexit buccaneer rakes in 2.75%” it would not have the same ring to it now would it. 🙂

Here are a few sentences from that article.

A hedge fund tycoon made more than £220 million for himself and his investors yesterday after betting on Brexit.

As many in the City nursed heavy losses, staunch Leave supporter Crispin Odey declared: ‘I think I may be the winner.’

He is one of a handful of hedge fund bosses to have hit the jackpot after taking big ‘short’ positions on company stocks and sterling, betting on their value falling in the aftermath of a vote to Leave.

Now please pay attention to the words “a handful”. So out of the 1000’s of investment bankers and hedge funds a handful got it right.

If you actually looked at all the trades that were taken in the hours of the Brexit vote, you would probably find that traders that rely solely on technical analysis, did far better from that move than the fundamental guys did.

Mr Odey also revealed his trading position had left him in line for huge losses if financial markets had risen, and he had lost his gamble.

So he picked a side, and gambled his investors money, and was correct. Do you think we would have been told about his huge losses if the gamble had gone against him? Well you are not hearing about the other hedge fund guys who gambled the wrong way are you.

Can i just make a point here that i do not like the word gamble, as trading is not about gambling. You take calculated risks based on high probability, and the higher the probability, the more success you will have.

So why do hedge funds and investment banks rely heavily on fundamental analysis and not on technical analysis?

The main reason is, they are managing huge sums of money, and they cannot enter and exit the market as a retail trader would. They have to build up a position, and an opinion over time, they add or subtract from that position as the fundamentals change.

To enter and exit the market with one trade would not only spook the market, it would also leave them in a vulnerable position should the market move against them. They have to hedge in and out of the market, building up an average price for their holdings, hence the term hedge fund. This strategy leaves them less exposed to currency fluctuations than they would be if they were all in, all out.

Retail traders can trade this way too if they know how to do it, but it does not mean that this way is better. It does not mean that fundamental analysis is any better than technical analysis, its just a safer way to trade large sums of money.

How i trade the Forex market?

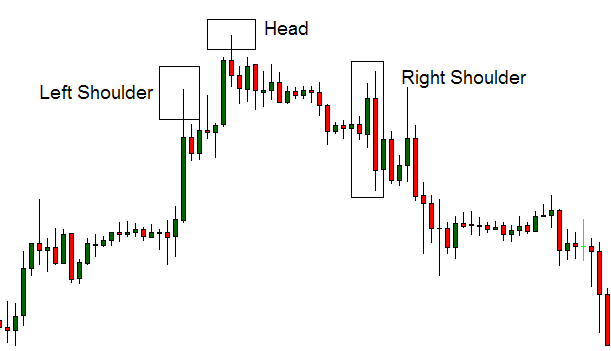

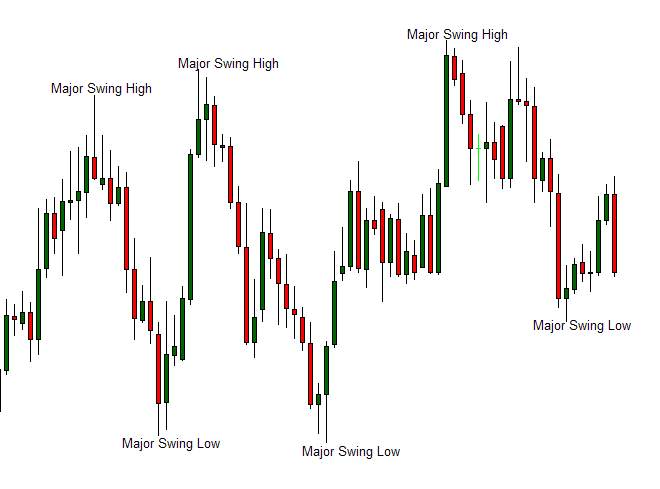

I personally trade 70% technical and 30% fundamental. And when i say technical i am talking about reading a chart rather than reading a news story. People get technical analysis confused with indicators. They think that technical analysis is putting moving averages on your chart and waiting until they cross.

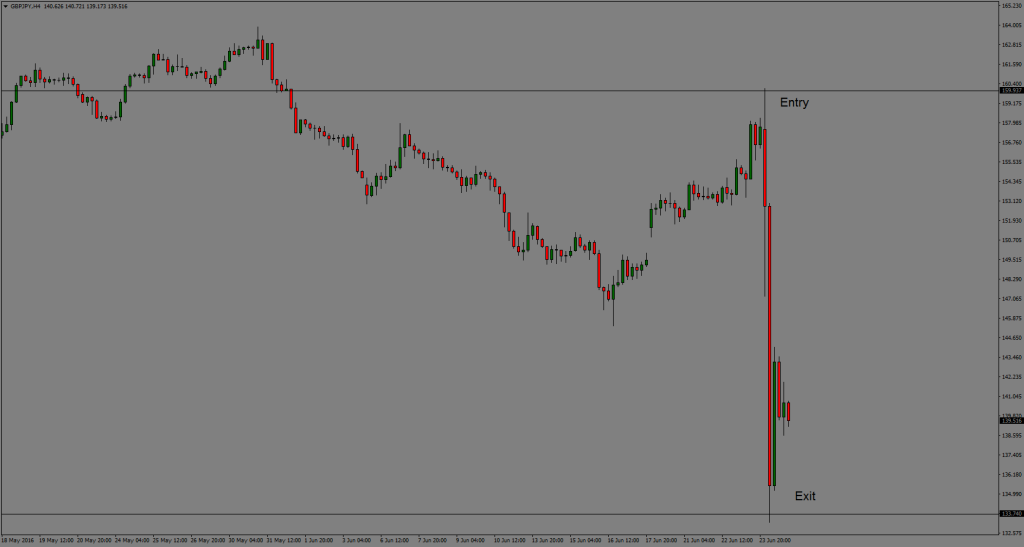

I trade by reading a chart correctly, and understanding what makes the market move. If you look at my article on the Brexit trade, you will see that the trade was purely based on chart reading. No fundamentals were involved at all in that trade.

Almost everyone that trades fundamentals got that trade wrong, but if you had been trading primarily from a technical standpoint, you would have had a much better chance of success.

So to all the trading providers out there that are telling people the reason they are losing money in the market is because they are trading technical analysis i say this.

The reason they are losing money is because they do not know how to trade.

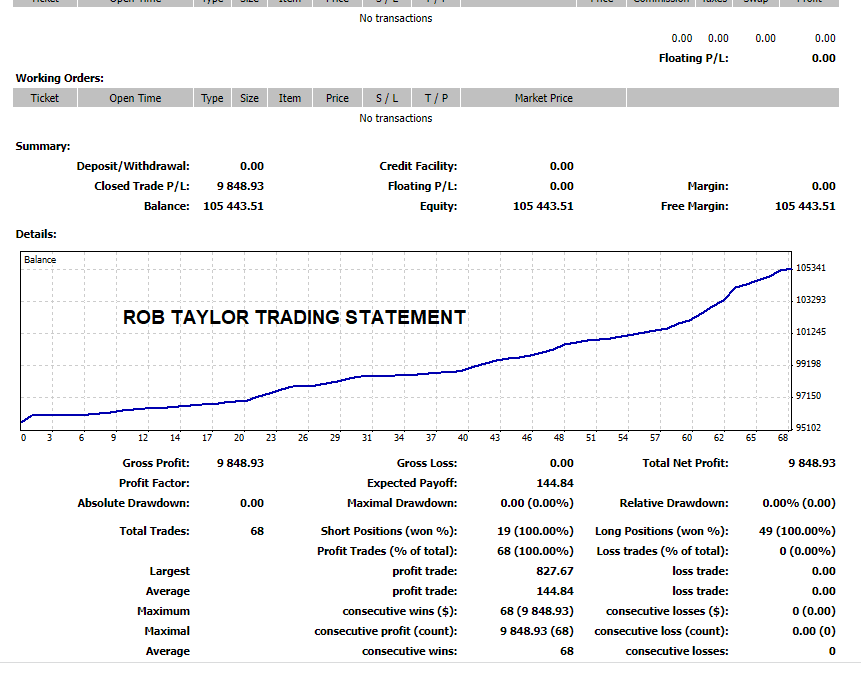

It has nothing to do with fundamental or technical analysis. You do not need to know anything at all about fundamental analysis to make money in the Forex market, and that’s 100% true and i can prove it.

Fundamental analysis is not the answer to consistent profitability.

So if you are a technical trader that is losing money, and you are considering paying some of these training providers to teach you how to trade fundamentals like hedge funds and investment banks, just think about the Brexit trade. I am not saying what they teach is not going to help you, but its not the answer to consistent profitability that they make it out to be.

Courses that offer to teach you the fundamentals of trading are the in thing at the moment, and a lot of training providers are jumping on the bandwagon to offer this because of the failings of traditional technical based training providers.

Some retail traders think that by taking a course on fundamental analysis they will find the holy grail, but this is not the case. Fundamental analysis is just one approach to trading, and it does not guarantee you trading success. I make a lot more money in a lot less time with my chart reading skills, than i could ever make by following fundamentals.

I know what these guys teach, but they do not know what i teach. So just think about that, when you are considering whether to pay these guys, or to pay me to teach you how to trade.

You get the best of both worlds with my training course. 🙂

How amazing would it be to be able to learn a great Forex trading strategy, and to make money on autopilot while you are learning it. Well now you can.

How amazing would it be to be able to learn a great Forex trading strategy, and to make money on autopilot while you are learning it. Well now you can.