There are many Forex candlestick patterns, but in this article we will look at a bearish pin bar rejection candle.

A pin bar, or hammer candle, as some traders call it, is a very good signal of a price reversal. Price reversals are the holy grail of Forex trading, and my whole trading strategy is based on using Forex candlestick patterns, to find levels on the chart, where there is a high probability that the price will reverse. If you can identify price reversals with high probability, then you will consistently make money from Forex trading. Forex candlestick patterns are a major part of price action Forex trading, and when mastered they can produce some very profitable trades.

So what is a pin bar rejection candle, and how is it formed?

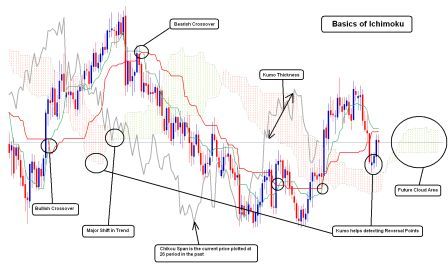

The above chart shows a bearish pin bar reversal candle on the Euro Dollar pair that formed this week, which resulted in a very profitable trade. I took this trade and banked 83 pips from the move down.

The concept behind this bearish pin bar candle, or any pin bar candle is shift in sentiment. In this pin bar candle the sentiment shifted from bullish to bearish. At one point in the candle formation the candle was totally green, and buyers were in control of price, and were happy to buy at this level. At the top of the pin bar the buyers ran out, and the sellers took over, forcing the price back to almost the opening level.

As this pin bar is a 4 hour candle, the buyers at the top of the candle were now sitting on heavy losses, and the sellers were sitting on a nice profit. Now, one of 2 things can happen next, buyers could either see value at a lower price, and add to their position, which would push the price back up and force sellers out, or they could have a shift in sentiment and close their trade for a loss, which would further add to the selling pressure, and push the price down further. In this case they had a change of heart and closed their trades for a loss. This change of sentiment together with sellers adding to their already profitable positions, sees the price move lower. When the candle closes as a pin bar, this signals that sellers are in control of price, and more sellers join the party, which pushes the price down further, and starts a major move down.

To add to the negative sentiment the pin bar has rejected at a key level of resistance, which encourages even more sellers into the market, which adds further weight to the move down.

Forex Candlestick Patterns.

If you study Forex candlestick patterns, you will see the pin bar rejection candle on many different time frames, and at many different levels on the chart, but they do not always indicate that a reversal is imminent. Some work, but some fail. You have to know with the highest probability which ones will work, and which ones will fail, and this is where i come in. I have studied Forex candlestick patterns for over 8 years and i can predict with the highest probability which will work and which will fail. Please see my Forex training course for more information.

If you found this article to be helpful to you, please like it on Facebook, share it on Twitter, or bookmark it using the social bookmarking buttons below. Thanks. 🙂