I say virtually impossible. It is possible to make money as a retail trader but the odds are firmly stacked against you. The statistics show that only 5% of retail traders make money consistently, but in reality the chances of success are probably less than 3%.

I say virtually impossible. It is possible to make money as a retail trader but the odds are firmly stacked against you. The statistics show that only 5% of retail traders make money consistently, but in reality the chances of success are probably less than 3%.

So taking into account that only 3% of traders that start out on this journey, achieve consistent profitability, why do so many people still want to get involved in Forex trading.

Well i suppose its for the same reason that people play the lottery. I don’t play the lottery by the way. I have no desire to throw away my money on a 50 million to 1 shot.

But taking into account the odds of lottery success, Forex trading success is a much better option.

Financial freedom, working hours that suit, spending more time with friends and family, working from home, being your own boss. These are all reasons why people get involved in Forex trading.

All of these reasons are valid, and attainable as a Forex trader, but they come at a price. Nothing in life is free, but you get out what you put in.

Determination, desire, discipline, dedication, are qualities that you need to be successful, but without education the other qualities will not be enough for Forex trading success.

Why is it so hard to succeed as a retail trader?

Here are some reasons why retail traders fail to make it in this business.

Not enough capital.

This is something that causes a lot of traders to fail. Most retail traders are sold a dream, a dream that they can turn a 100 bucks into a million bucks, when in fact that really is not how trading works at all.

If you only have a 100 bucks to fund your account, just forget live trading, because you will only lose your 100 bucks. If you go down the same route as the majority of traders, then you will probably blow a min of 3 trading accounts before you get to any sort of consistent profitability. That’s if you are lucky.

If you only have a 100 bucks to fund your account, just forget live trading, because you will only lose your 100 bucks. If you go down the same route as the majority of traders, then you will probably blow a min of 3 trading accounts before you get to any sort of consistent profitability. That’s if you are lucky.

Top tip: Divide your start up capital into 4 lots, and open your first account with a quarter of your start up capital. You then have enough money to fund 3 blown accounts, and still have something left to trade with.

Poor trading education.

If you have enough capital to fund 4 trading accounts then getting the correct education is a must to give you any real chance of success. Everyone thinks you can teach yourself how to trade by reading books, or watching trading videos on YouTube. Although you may be able to learn the basics this way, you can only be successful in the Forex business if you are educated by a professional trader.

This job is a lot harder than it looks, and paying a professional to teach you how to trade correctly is the only way in my opinion that you can move forward and get consistently profitable in your trading.

You want to make money in this business, and you want to be able to do it in as little time as possible. By trying to teach yourself to trade you are doing the complete opposite. You will lose money, and you will lose time. The only thing you will gain is stress.

Investing in a professional Forex training program will save you a lot of money, a lot of time, and a lot of stress.

Lack of discipline.

Discipline is something that a lot of traders struggle with. Fear and greed is one of the biggest reasons why traders fail. Having the knowledge needed to be successful will not be enough if you cannot control your discipline.

Warren Buffet is probably the best example of a trader that is 100% unaffected by fear and greed issues.

Warren Buffet is probably the best example of a trader that is 100% unaffected by fear and greed issues.

He is one of the richest guys in the world but he has not made his money by being greedy, or by being fearful. He has made his money be being clever, and very well informed.

Its a lot easier to control fear and greed issues if you have the correct education, but it can still cause traders problems.

I like to think of trading in the way you cross a busy road. If you have not been taught how to successfully cross the road, the chances of getting squashed by a bus are very high, but even when you know how to cross the road, there is still a temptation to go for a small gap in the traffic, and try to make it to the other side without waiting for the road to become clear so you can cross safely.

Trading is about waiting for the road to become clear, so you can trade safely.

False beliefs about the market and how it works.

Most of the education available to retail traders either online, in books, or in other training courses is poor to say the least. Some of it is bordering on madness to be honest, but traders still pay for, and dedicate time to learning this crap, and it will not help them one bit in their trading journey.

Some well respected Forex training providers have no idea how the market really works, and importing this knowledge into traders heads is leading to false beliefs about the market and how to trade it. These false beliefs will make it impossible for a trader to make money consistently.

But because the trader does not know that what he or she believes is false, they blame their failures on a lack of discipline, when in fact the problem is a lack of knowledge.

So whats the answer?

Well the answer is to hire a professional trader like myself to teach you how to trade. And if you think its too expensive to hire a professional trader, just think about how much it will cost you if you hire an amateur.

Thanks for visiting my blog, have a great day. 🙂

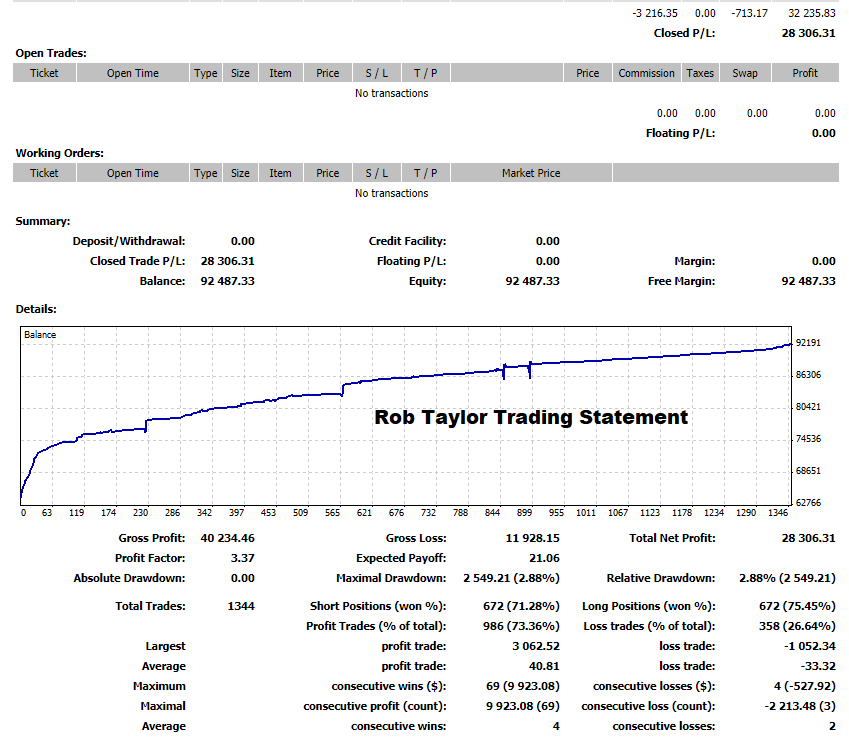

Successful Forex traders are a rare breed. Only 5% of retail traders actually make money in the markets consistently.

Successful Forex traders are a rare breed. Only 5% of retail traders actually make money in the markets consistently.  As some of you already know i recently launched a new Forex training course called

As some of you already know i recently launched a new Forex training course called