Einstein once said that the definition of madness is doing the same things over and over again and expecting different results.

Einstein once said that the definition of madness is doing the same things over and over again and expecting different results.

So will 2018 be your year for Forex trading success? Not if you are doing the same things that you were doing in 2017 it won’t.

Less than 5% of retail traders consistently make money in the market. Why?

Retail trading strategies don’t work, its as simple as that.

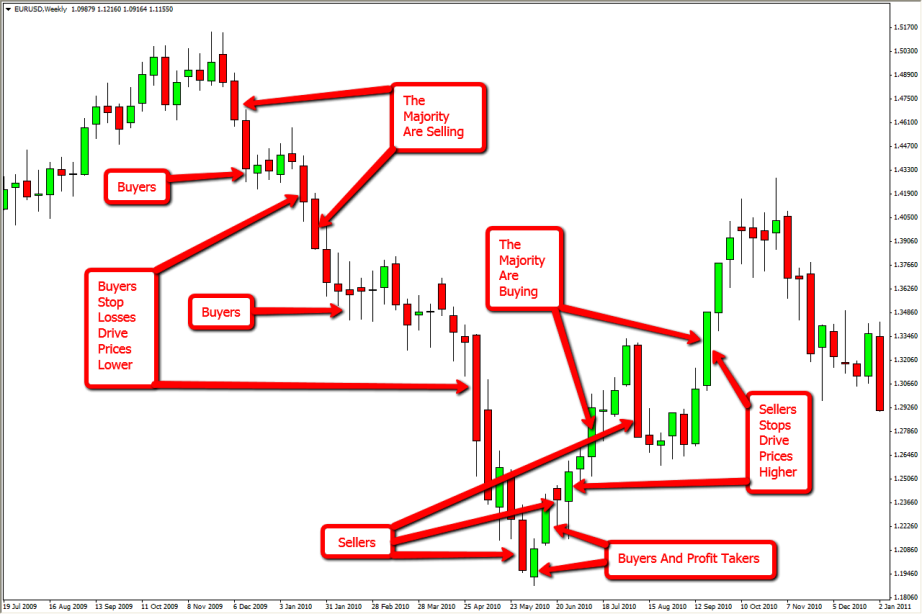

What do I mean by a retail trading strategy? A retail trading strategy is any strategy that uses beliefs about the market that are incorrect. Beliefs that are built up by years of watching YouTube video’s and visiting sites like Forex Factory and Baby Pips.

Retail traders do not understand how professional traders trade. Despite all the so-called Forex gurus that claim to be able to teach you how to trade price action, or teach you how to trade order flow, or teach you how the big banks trade, or teach you how the institutional traders trade, retail traders are still in the dark about what really goes on in the Forex market.

The big banks do not trade how you think they trade, the institutional traders do not trade how you think they trade, professional traders do not trade how you think they trade.

Why are you doing the same things over and over again?

Because you don’t know any different that’s why. You have been brainwashed by charlatan educators who claim that they know what they are talking about when they don’t. You have taken too many courses for a few 100 bucks, and you think you know how to read a chart, but you don’t.

If you don’t know that you are doing it wrong then you cant change it. But trust me if you are losing money in the markets then you are doing it wrong, and you need to change what you are doing.

Thank you for visiting my site, but don’t go just yet.

How ever you may have reached my site today I would like to thank you for visiting, but before you click away just stop for one second and listen to this. This is a pivotal moment in your Forex trading career. If you read some of the articles on my site and click away then you have just missed an incredible opportunity to find out what you have been searching for your whole trading career. How the Forex market really works.

I am a real life professional trader. I have been where you are now, I have done what you are doing now. And now I am prepared to share all of my years of knowledge and experience with you, to enable you to change the way you look at the market forever. I don’t just claim to know what I am talking about. I actually do know what I am talking about, and I prove it to my students day in and day out in my live trading room.

Free access to my earn while you learn and my live trading room.

So here is an offer you can’t refuse. Just to prove to all the doubters out there that I am the real deal I am going to put my money where my mouth is. For all traders who enroll for my 15 or 30-hour course this month, I am going to give you free access to my live trading room, and my earn while you learn offer, for life. That is a saving of £1000.

Why am I doing this? Because the feedback that I have been getting from students that are in the live trading room is amazing, and I feel that everyone that takes my 15 or 30-hour course should have the benefit of the trading room, as it really does transform the way you look at the market and turbocharges your learning.

So now you have no excuses. Make 2018 the year that you do something different. Make 2018 the year that you finally realize your dream of becoming a successful trader. Make 2018 the year that you get a proper trading education from a real trader that makes his money from trading, not from training.

For more information on my Forex trading course please click here.

Thanks for visiting, and remember this is a pivotal moment in your Forex trading career, are you going to click away, or are you going to contact me and see what I have to say?

Successful Forex traders are a rare breed. Only 5% of retail traders actually make money in the markets consistently.

Successful Forex traders are a rare breed. Only 5% of retail traders actually make money in the markets consistently.  As some of you already know i recently launched a new Forex training course called

As some of you already know i recently launched a new Forex training course called